Whether you’re considering selling your business or acquiring another one, due diligence is a must. In many mergers and acquisitions (M&A), prospective buyers obtain a quality of earnings (QOE) report to evaluate the accuracy and sustainability of the seller’s reported earnings. Sometimes sellers get their own QOE reports to spot potential problems that might derail […]

If you’re interested in investing in tax-free municipal bonds, you may wonder if they’re really free of taxes. While the investment generally provides tax-free interest on the federal (and possibly state) level, there may be tax consequences. Here’s how the rules work. Purchasing a bond If you buy a tax-exempt bond for its face amount, […]

The average cost of a data breach has risen to a record high, according to a new study by the independent research firm Ponemon Institute. The study found that the global average cost grew from $4.24 million per incident in 2021 to $4.35 million in 2022, an increase of roughly 2.6%. Moreover, the global average cost […]

If you have a child or grandchild who’s going to attend college in the future, you’ve probably heard about qualified tuition programs, also known as 529 plans. These plans, named for the Internal Revenue Code section that provides for them, allow prepayment of higher education costs on a tax-favored basis. There are two types of […]

Inflation is up 8.3% year over year, according to the latest data from the U.S. Bureau of Labor Statistics. Many factors — including supply chain disruptions, multi-trillion-dollar government spending packages, the war in Ukraine and economic fallout from the COVID-19 pandemic — have contributed to higher prices at the gas pumps, on the grocery shelves and […]

Now that fall is officially here, it’s a good time to start taking steps that may lower your tax bill for this year and next. One of the first planning steps is to ascertain whether you’ll take the standard deduction or itemize deductions for 2022. Many taxpayers won’t itemize because of the high 2022 standard […]

Donating time to a charity can be a rewarding experience — both for you and people (or animals) who benefit from the organization’s mission. But your efforts may also provide you with some well-deserved tax breaks if you itemize deductions on your tax return. Although you can’t deduct the “value” of your services, here are 10 […]

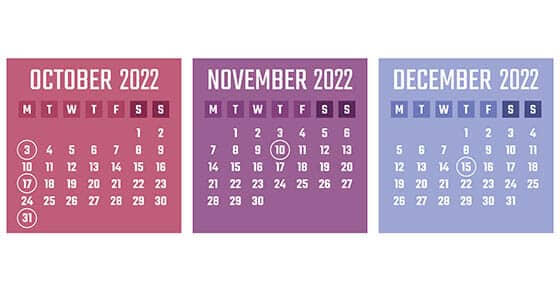

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. Note: […]

How high can you jump? To claim a deduction for medical expenses on your personal tax return, you have to clear an annual hurdle imposed by the IRS. Although the bar was lowered a few years ago, it still takes a significant leap to clear this threshold. Fortunately, you may be able to count on more […]

In today’s tough economy, you may find yourself struggling to cover your day-to-day expenses. But rising interest rates are making traditional loans more expensive. In such an environment, you might consider borrowing funds from your 401(k) retirement account, if your plan permits it. But you’ll need to weigh the pros and cons before taking the plunge. […]