If you’re considering guaranteeing, or are asked to guarantee, a loan to your closely held corporation, it’s important to understand the potential tax consequences. Acting as a guarantor, endorser or indemnitor means that if the corporation defaults, you could be responsible for repaying the loan. Without planning ahead, you may face unexpected tax implications. A […]

Do you and your spouse together operate a profitable unincorporated small business? If so, you face some challenging tax issues. The partnership issue An unincorporated business with your spouse is classified as a partnership for federal income tax purposes, unless you can avoid that treatment. Otherwise, you must file an annual partnership return using Form 1065. […]

At back-to-school time, much of the focus is on the students returning to the classroom — and on their parents buying them school supplies, backpacks, clothes, etc., for the new school year. But teachers are also buying school supplies for their classrooms. And in many cases, they don’t receive reimbursement. Fortunately, they may be able […]

Divorce is stressful under any circumstances, but for business owners, the process can be even more complicated. Your business ownership interest is often one of your largest personal assets, and in many cases, part or all of it will be considered marital property. Understanding the tax rules that apply to asset division can help you […]

If you make quarterly estimated tax payments, the amount you owe may be affected by the One Big Beautiful Bill Act (OBBBA). The law, which was enacted on July 4, 2025, introduces new deductions, credits and tax provisions that could shift your income tax liability this year. Tax basics Federal estimated tax payments are designed to ensure […]

If you own an unincorporated small business, you may be frustrated with high self-employment (SE) tax bills. One way to lower your SE tax liability is to convert your business to an S corporation. SE tax basics Sole proprietorship income, as well as partnership income that flows through to partners (except certain limited partners), is subject […]

The newly enacted One, Big, Beautiful Bill Act (OBBBA) represents a major move by President Trump and congressional Republicans to roll back a number of clean energy tax incentives originally introduced or expanded under the Inflation Reduction Act (IRA). Below is a summary of the key individual tax credits that will soon be scaled back […]

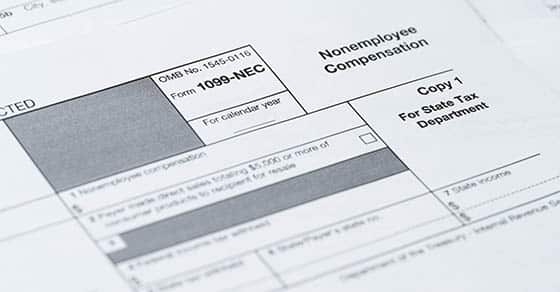

The One, Big Beautiful Bill Act (OBBBA) contains a major overhaul to an outdated IRS requirement. Beginning with payments made in 2026, the new law raises the threshold for information reporting on certain business payments from $600 to $2,000. Beginning in 2027, the threshold amount will be adjusted for inflation. The current requirement: $600 threshold […]

For many years, businesses of all shapes and sizes have at least considered sustainability when running their operations. Many people — including customers, investors, employees and job candidates — care about how a company impacts the environment. And reducing energy use, water consumption and waste generally lowers operational costs. However, the current “environment regarding the […]

The alternative minimum tax (AMT) is a separate federal income tax system that bears some resemblance to the regular federal income tax system. The difference is that the individual AMT system taxes certain types of income that are tax-free under the regular system. It also disallows some deductions that are allowed under the regular system. […]