Let’s say you own real estate that has been held for more than one year and is sold for a taxable gain. Perhaps this gain comes from indirect ownership of real estate via a pass-through entity such as an LLC, partnership or S corporation. You may expect to pay Uncle Sam the standard 15% or 20% […]

Many businesses have established employee assistance programs (EAPs) to help their workforces deal with the mental health, substance abuse and financial challenges that have become so widely recognized in modern society. EAPs are voluntary and confidential work-based intervention programs designed to help employees and their dependents deal with issues that may be affecting their mental […]

Navigating the complexities of tax law can be difficult, especially when faced with an unexpected tax bill due to the errors of a spouse or ex-spouse. The reason for such a bill has to do with the concept of “joint and several” liability. When a married couple files a joint tax return, each spouse is […]

If you requested an extension for your 2023 federal income tax return, you have until six months from the original due date — October 15, 2024, to be exact — to wrap things up. This extra time may give you the opportunity to lower your overall tax bill and possibly increase a refund. Here are 10 […]

Summer is a great time for business owners to review their estate plans. Maybe your kids are home for summer break, so they’re top of mind. Or perhaps you’re vacationing with relatives or getting together for a backyard BBQ. Whatever the reason you’re spending time with your family, consider having an open discussion with them about […]

Get ready: The upcoming presidential and congressional elections may significantly alter the tax landscape for businesses in the United States. The reason has to do with a tax law that’s scheduled to expire in about 17 months and how politicians in Washington would like to handle it. How we got here The Tax Cuts and […]

For a couple decades or so now, companies have been urged to “get on the cloud” to avail themselves of copious data storage and a wide array of software. But some businesses are learning the hard way that the seemingly sweet deals offered by cloud services providers can turn sour as hoped-for cost savings fail […]

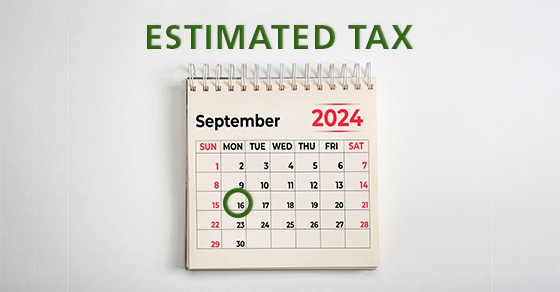

Federal estimated tax payments are designed to ensure that certain individuals pay their fair share of taxes throughout the year. If you don’t have enough federal tax withheld from your paychecks and other payments, you may have to make estimated tax payments. This is the case if you receive interest, dividends, self-employment income, capital gains, […]

Federal payroll taxes are a necessary evil for both employers and employees. Under the Federal Insurance Contributions Act (FICA), employees must pay Social Security and Medicare taxes. For their part, employers must withhold the tax from employee wages and also pay their share of FICA tax. But there’s another, lesser-known payroll tax that some of your […]

Regardless of their size, businesses rely heavily on technology. Although your network and computer-related tools are essential to function, they’re also a potential liability because they can offer cybercriminals access to your company. To protect against this complex and ever-evolving threat, businesses must deploy a comprehensive cybersecurity program. Your Arsenal You should already have a cybersecurity […]