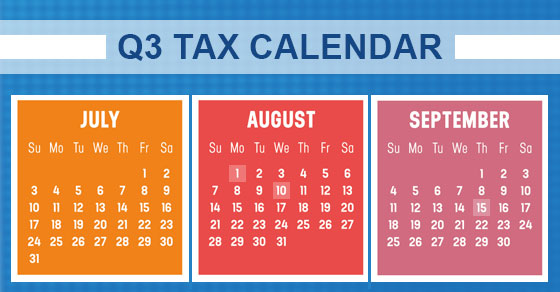

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. August […]

With business travel picking up again and summer fast approaching, many business owners may be mulling trips that combine work with vacation or other personal activities. A quick refresher on the IRS rules related to deducting business vs. personal travel costs can help you reduce your tax bill next year. General Requirements Business expenses must be […]

Are you in the early stages of divorce? In addition to the tough personal issues that you’re dealing with, several tax concerns need to be addressed to ensure that taxes are kept to a minimum and that important tax-related decisions are properly made. Here are five issues to consider if you’re in the process of […]

Once upon a time, consumers generally expected a clear line of demarcation between advertising and editorial content. While holdouts remain — especially from older generations — younger audiences who came of age during or after the advent of social media often have no problem with blending the two. So while straightforward “banner” and “tile” digital ads […]

Accounts payable is a critical area of concern for every business. However, as a back-office function, it doesn’t always get the attention it deserves. Once in place, accounts payable processes tend to get taken for granted. Following are some tips and best practices for improving your company’s approach. Be strategic Too often, businesses take a […]

As a result of the current estate tax exemption amount ($12.06 million in 2022), many people no longer need to be concerned with federal estate tax. Before 2011, a much smaller amount resulted in estate plans attempting to avoid it. Now, because many estates won’t be subject to estate tax, more planning can be devoted […]

The labor market is tighter today than it has been in decades, and many employers are going above and beyond the ordinary to attract and retain top talent. One idea for your organization is to sweeten the pot of fringe benefits. A cafeteria plan, for example, allows employers to offer more benefits to employees, generally at […]

Every business wants to engage in strategic planning that will better position the company to sell more to current customers — and perhaps expand into new markets. Yet the term “strategic planning” is so broad. It’s easy to get overwhelmed by all the possible directions you could go in and have a hard time choosing […]

Some people who begin claiming Social Security benefits are surprised to find out they’re taxed by the federal government on the amounts they receive. If you’re wondering whether you’ll be taxed on your Social Security benefits, the answer is: It depends. The taxation of Social Security benefits depends on your other income. If your income […]

Individuals commonly establish estate plans with trusts to mitigate their own tax exposure. But what about their heirs? With bequests, family members often inherit assets that immediately become part of their taxable estates. Setting up an “inheritor’s” trust now can help ease the burden when a loved one may be least capable of shouldering it. Better than Bequests […]